dallas texas sales tax rate 2020

Average Sales Tax With Local. Local taxing jurisdictions cities counties special purpose districts and transit authorities can also impose up to 2 percent sales and use tax for a maximum combined rate of 825 percent.

Average Corporate Income Tax Rates In Europe And Surrounding Countries 4592x3196 Oc R Mapporn

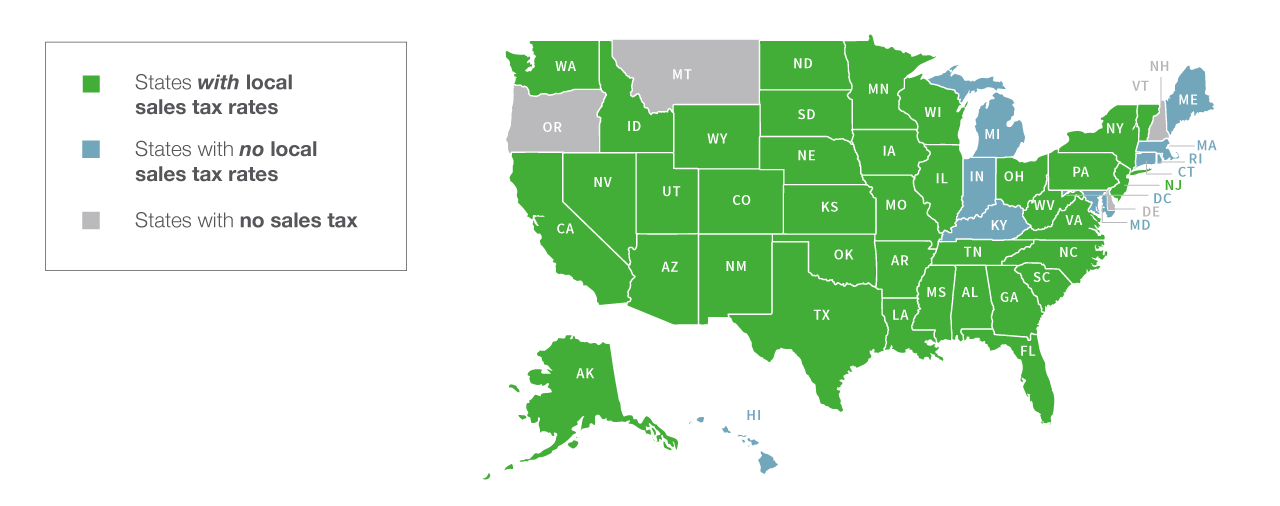

With local taxes the total sales tax rate is between 6250 and 8250.

. The total local sales tax rate in any one particular location that is the sum of the rates levied by all local taxing authorities can never exceed 2 percent. Ad Find Out Sales Tax Rates For Free. El paso tx sales tax rate.

Download and further analyze current and historic data using the Texas Open Data Center. There are a total of 982 local tax jurisdictions across the state collecting an average local tax of 1678. The 825 sales tax rate in Dallas consists of 625 Texas state sales tax 1 Dallas tax and 1 Special tax.

The total sales tax rate in any given location can be broken down into state county city and special district rates. It is a 686200 Acres Lot in Central Ave. The County sales tax rate is 0.

What is Denvers sales tax. This report shows jurisdictions adopting new or changed sales tax rates in the past 14 months. Fast Easy Tax Solutions.

Texas has a 625 sales tax and Dallas County collects an additional NA so the minimum sales tax rate in Dallas County is 625 not including any city or special district taxes. The minimum combined 2022 sales tax rate for Dallas Texas is. For tax rates in other cities see Texas sales taxes by city and county.

The texas sales tax rate is currently. Groceries prescription drugs and non-prescription drugs are exempt from the Texas sales tax. 4544 Yancy St Dallas TX 75216 is listed for sale for 58000.

The Texas state sales and use tax rate is 625 percent but local taxing jurisdictions cities counties special-purpose districts and transit authorities also may impose sales and use tax up to 2 percent for a total maximum combined rate of 825 percent. The Texas sales tax rate is currently. The sales tax rate in Dallas is 825 percent of taxable goods or services sold within c ity limits.

The counties listed below have a 05 percent sales and use tax rate unless indicated with an asterisk. Select the Texas city from the list of popular cities below to see its current sales tax rate. Name Local Code Local Rate TotalRate Name Local Code Local Rate TotalRate AustinETravis Gateway Lib Dist Travis Co 6227668 010000 082500 Barclay 067500 AustinMTA 3227999 010000 FallsCo 4073002 005000.

Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services. 2022 Texas state sales tax. The county tax is collected in addition to state tax and any other local taxes city transit and special-purpose district as applicable.

Name Local Code Local Rate Total Rate. TEXAS SALES AND USE TAX RATES January 2022. The minimum combined 2021 sales tax rate for dallas texas is.

This is the total of state county and city sales tax rates. 2022 Tax Rates Estimated 2021 Tax Rates. In Texas 124 counties impose a county sales and use tax for property tax relief.

The December 2020 total local sales tax rate was also 8250. 214 653-7811 Fax. Texas has recent rate changes Thu Jul 01 2021.

The Texas sales tax rate is currently 625. The rates shown are for each jurisdiction and do not represent the total rate in the area. The tax is collected by the retailer at the point of sale and forwarded to the Texas Comptroller on a monthly or quarterly basis.

825 Frisco Texas sales tax rate details The minimum combined 2021 sales tax rate for Frisco Texas is 825. This table shows the total sales tax rates for all cities and towns in Dallas County. There is no applicable county tax.

Local Sales Tax Rate Information Report. The County sales tax rate is. The Dallas sales tax rate is.

Uc unable to compute percentage change The december 2020 total local sales tax rate was also 8250. Records Building 500 Elm Street Suite 3300 Dallas TX 75202. The sales tax rate in dallas is 825 percent of taxable goods or services sold within c ity limits.

Exact tax amount may vary for different items. The Texas state sales tax rate is 625 and the average TX sales tax after local surtaxes is 805. This is the total of state county and city sales tax rates.

You will be required to collect both state and local sales and use taxes. The state sales tax rate in Texas is 6250. You can print a 825 sales tax table here.

Texas has state sales tax of 625 and allows local governments to collect a local option sales tax of up to 2. In Texas the combined area city sales tax is collected in addition to state tax and any other local taxes transit county special purpose district when applicable. The Dallas sales tax rate is 1.

What is sales tax in Frisco TX.

3 Must Have Tools To Manage The Day To Day Of Your Online Business Online Business Online Business Tools Must Have Tools

15 States With No Income Tax Or Very Low Which States Can Save You The Most Bhgre Homecity

The Seller S Guide To Ecommerce Sales Tax Taxjar Developers

States With Highest And Lowest Sales Tax Rates

Texas Sales Tax Guide And Calculator 2022 Taxjar

Texas Sales Tax Guide For Businesses

Compare Sales Income And Property Taxes By State Us Map 2011 My Money Blog

Texas Sales Tax Small Business Guide Truic

The Seller S Guide To Ecommerce Sales Tax Taxjar Developers

States With Highest And Lowest Sales Tax Rates

Finance Department Balch Springs Tx

2021 2022 Tax Information Euless Tx

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Taxes Celina Tx Life Connected

U S States With Highest Gas Tax 2022 Statista

Sales Tax Rates In Major Cities Tax Data Tax Foundation

15 States With No Income Tax Or Very Low Which States Can Save You The Most Bhgre Homecity

What Is The Dallas Texas Sales Tax Rate The Base Rate In Texas Is 6 25

Property Taxes Levied On Single Family Homes Up 5 4 Percent Attom